Debt, Drama & Democracy

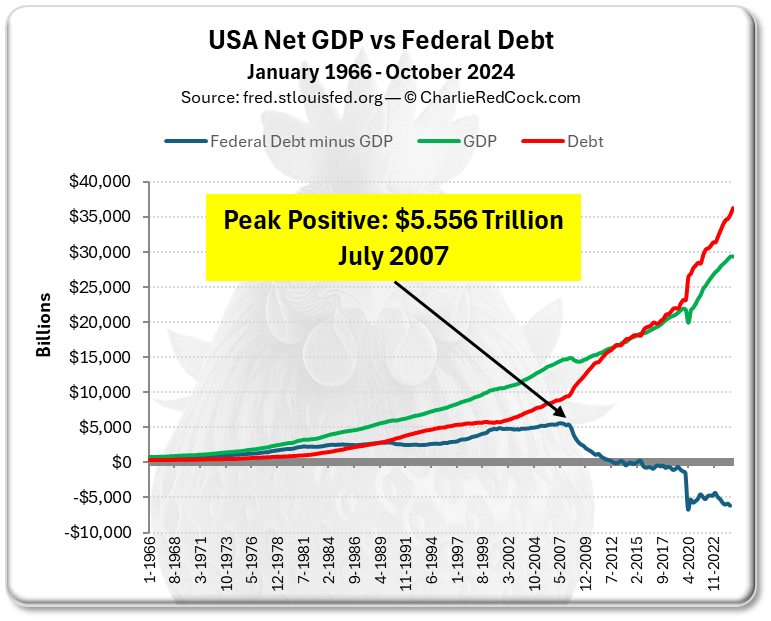

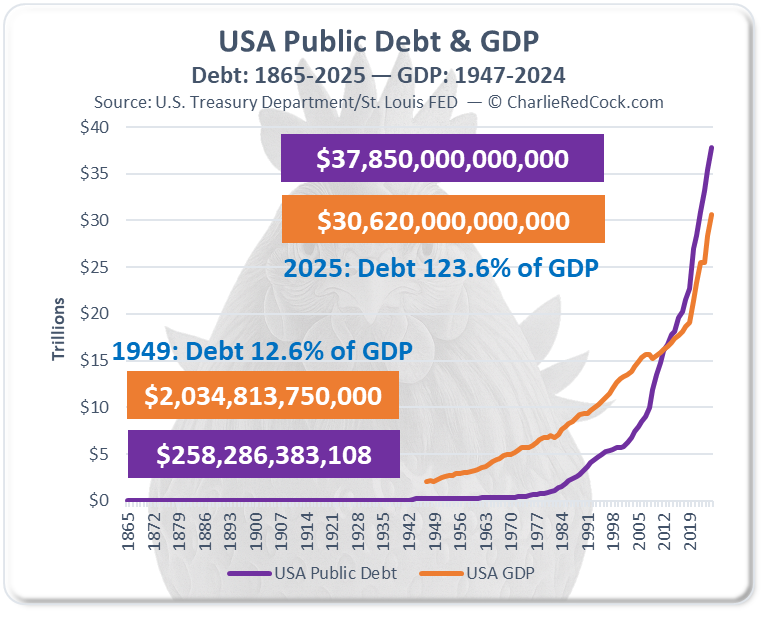

They say a picture is worth a thousand words, which is great, because apparently words aren’t paying down the debt either. So let’s sketch the burning question: what exactly triggered the hyperbolic, runaway, “hold-my-beer” public debt growth in the USA? Spoiler alert: it wasn’t defense spending or wars. That scapegoat has been dragged out of the trenches so many times it’s basically a zombie soldier at this point.

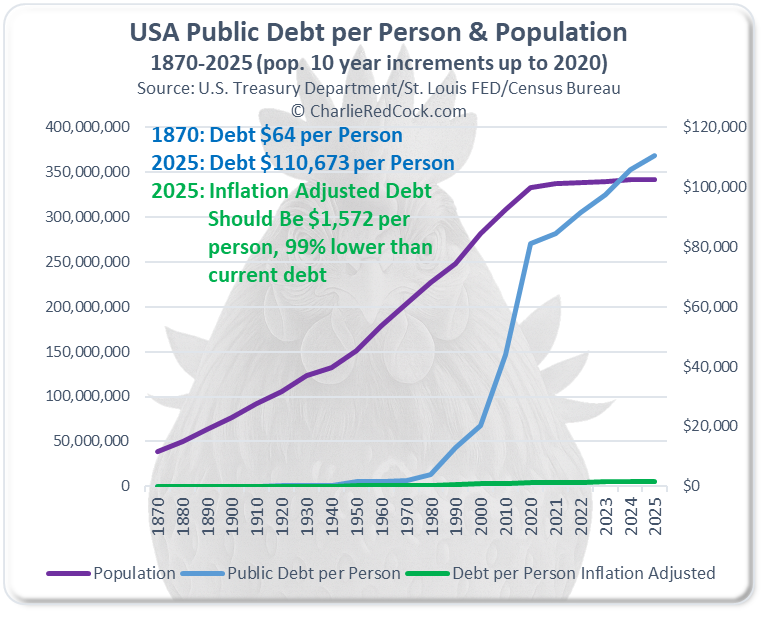

Now, in a fantasy world where government is “efficient,” debt wouldn’t exist. But back here in reality, efficiency is just a bedtime story for economists. In 1870, public debt was a quaint $64 per person—about a third of what a farm hand made in a year. Fast forward to today, and we’re sitting at $105,958 per person. That’s not just inflation—it’s debt on steroids. Adjusted for inflation, it should be $1,508, but hey, math is boring, so let’s just multiply it by 70 and call it progress. Oh, and by the way, $105,958 is roughly 300% of a farm worker’s annual wage, not 33%. So if you’re farming, congratulations—you’re already in debt before you buy your first shovel.

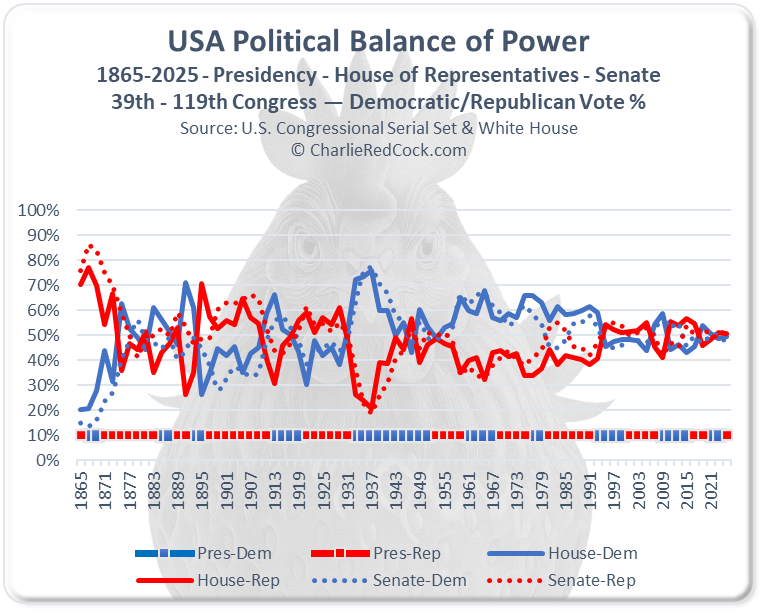

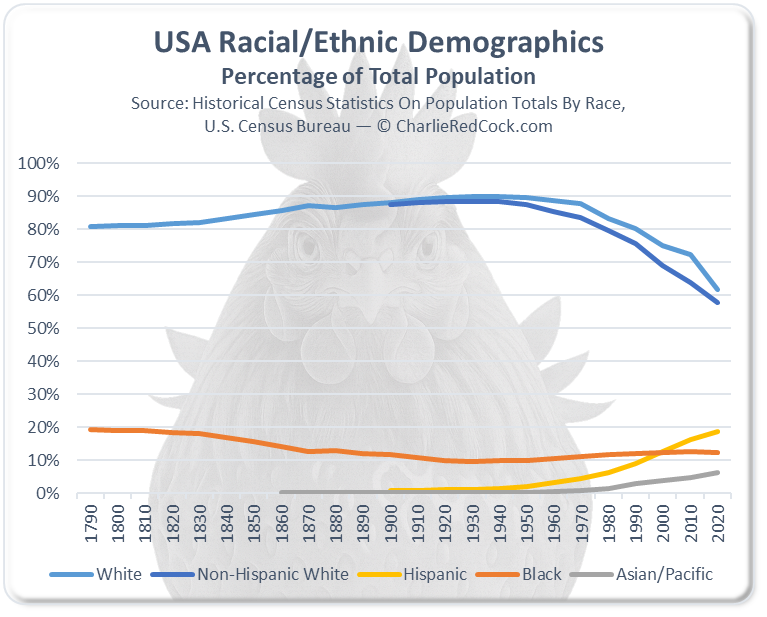

Why? Because demographics, productivity, and welfare policies have been playing hot potato with the economy for 50 years, while global “socio-techno-economic achievements” (translation: everyone inventing shiny toys and new ways to spend money) became the yardstick. Connect the dots—it’s less of a chart and more of a doodle of chaos.