Walmart/Kroger RedCock Index

Amazon validates the Index

The Walmart/Kroger RedCock Index could have worn a more respectable name, sure—but that would ruin the joke. After all, why pretend that most CEOs, C‑Suites, and Boards are anything more than decorative ballast for their corporations? Absurdity is the point. And isn’t that a hell of a claim to make with a straight face?

Take Walmart’s own Doug McMillon: recently stepping down from “active duty,” he now drifts toward the sunset armed with a participation trophy and a mountain of Walmart stock. The headlines cheer that he “nearly doubled revenue in 12 years.” Translation: he gets the yacht, you get the rollback aisle.

There’s a snag in that “nearly doubled” victory lap—and Doug isn’t the only one caught in it. The ever‑nagging CPI—better known to everyday mortals as that pesky inflation—tells a less flattering story. Enter the Walmart/Kroger RedCock Index.

Why Walmart and Kroger? Because they’re gloriously complexicated—together raking in more than three‑quarters of a trillion dollars in annual sales—and because they peddle the basics to schmucks like me. Which makes them a pretty decent mirror for the nation’s economic mood, whether we like the reflection or not. Here are the charts showing the data foundation of the index.

Walmart: What It Actually Means

Nominal Sales look heroic—like Doug McMillon deserves a statue made of rollback stickers.

CPI Adjusted Sales tell the truth: Walmart’s real economic impact peaked in 2015 and has been eroding since.

Inflation (CPI) is the villain in the background, quietly devouring purchasing power while CEOs collect trophies.

Doug didn’t double anything except the illusion. The RedCock Index exposes the gap between corporate applause and economic reality. Walmart’s revenue may be up, but its real value to the average shopper is down.

This chart is your ledger’s first tile:

When the blue line climbs and the orange line falls, America’s wallet shrinks while its headlines cheer.

Kroger: What It Actually Means

Kroger’s nominal growth looks respectable—like a well-dressed accountant who always arrives on time.

But CPI adjusted sales reveal the truth: the purchasing power of those billions has been eroding.

Inflation keeps climbing, and Kroger’s real value to the average shopper is shrinking—just more politely than Walmart’s.

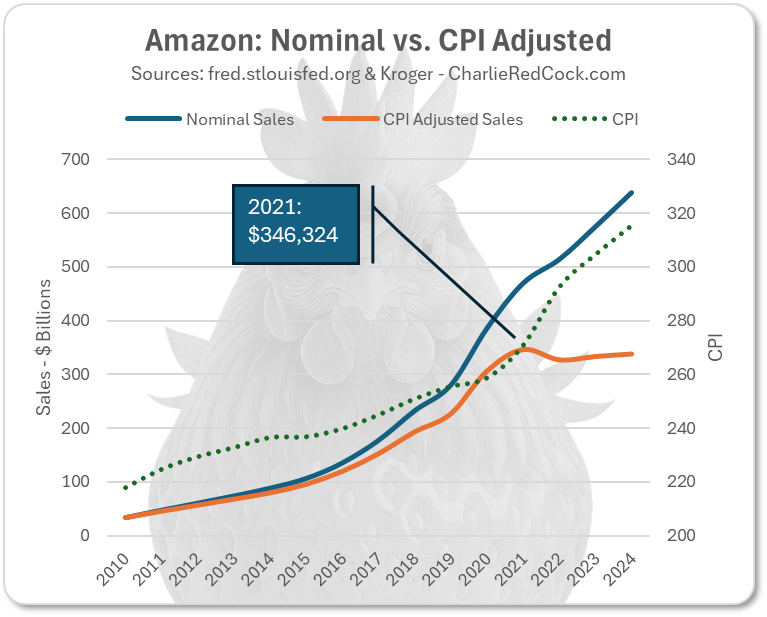

What about Amazon?

Amazon is younger, experienced fast growth over the last decade, but is sticking to the script like all good boys and girls. Reality can be an itchy inconvenience that cannot be avoided!

To summarize: the data spans from 2010 to 2024 and makes one thing painfully clear—this so-called “doubling” looks suspiciously like a “halving” in disguise. Calling it embarrassing doesn’t quite cut it. With all the MBAs and boardroom diplomas involved, it’s enough to make geese honk with laughter as they glide past on their way to chicken country, where illusions go to roost. Worse yet, CNBC—our national cheerleader in business drag—is apparently too incompetent to do simple math. They just nod, smile, and call it growth.