Debt: The Musical (Now Playing Forever)

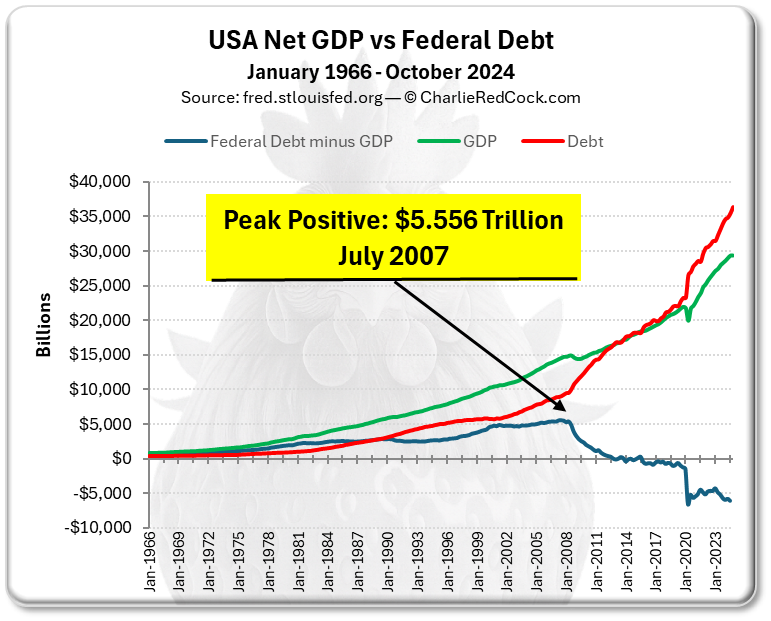

July 2007 marked the exact moment when the U.S. economy’s cumulative output (GDP) exceeded total federal debt by the widest margin in modern history: +$5.556 trillion. This wasn’t just a fiscal footnote — it was the high-water mark of national solvency. From 1966 to that point, America had produced $5.556 trillion more in GDP than it had borrowed. That surplus gap was the strongest net position the country ever held — before the tide turned and debt began outpacing growth, it was followed by a flood of stupidity.

Because right after that, Wall Street decided to turn millions of “no income, no job, no clue” loans into AAA-rated masterpieces and sell them globally. Banks and brokers made a killing. Rating agencies got paid to play dumb. And everyone involved made sure to keep zero risk for themselves — because accountability is for peasants.

The Fed kept money dirt cheap, so naturally, everyone believed housing prices only go up. When reality hit and people couldn’t pay, the whole pyramid scheme collapsed. Millions lost homes, banks imploded, and taxpayers got the honor of bailing out the geniuses who built it.

We were told “never again.” Translation: “never again… until we forget.”

No one went to jail.

The shady non-bank lenders came roaring back (now writing 70–80% of mortgages).

Wall Street is bundling risky loans again like it’s a bake sale.

Big investors are buying homes with cash, pricing out actual humans.

And for the rest of us? If you don’t have perfect credit or a fat down payment, lenders are once again offering 40–50 year loans, “bank-statement” loans, and investor loans that only care about rental income. Because clearly, if rents drop, nothing bad could possibly happen.

History isn’t repeating — it’s rhyming like a drunk poet. Same loopholes. Same greed. Same memory loss in Washington.

2008 wasn’t a “housing bubble.” It was a Wall Street scam with houses as the weapon. And the weapon is being reloaded.

Fast-forward to 2025

Guess who’s back? The same non-bank lenders (Rocket, UWM, etc.) now write 80% of all mortgages. They’re pushing 40–50 year loans, investor loans based on rental income, and cash-out refis like it’s 2006 with better branding. Wall Street is securitizing this stuff faster than you can say “credit default swap.”

But now there’s a new monster:

The U.S. has added $27 trillion in debt since 2008.

Interest payments alone are nearly $1 trillion a year.

Foreign buyers (China, Japan) are ghosting us, so rates have to stay high to attract anyone.

Translation for normal people: Mortgages are 7%+ instead of 3% because the country is broke and drowning in IOUs. And if this bubble pops, the Fed can’t slash rates to zero like last time — the debt ceiling is now a debt cathedral.

So here’s your forecast: Same greed + same loopholes + national debt on steroids = a crash that makes 2008 look like a warm-up act.